Fighting between Israel and Hamas has been ongoing for over two years in the Gaza Strip and there seems to be no end in sight. There are still 50 hostages being held by Hamas, in addition to the loss of life of Israeli soldiers. The Palestinian side has not only experienced a loss in civilian life, but food insecurity has also been an ongoing issue for Gazans throughout this conflict. Starvation of civilians is as heartbreaking as it is inevitable in a war zone, and it has made rounds in the news cycle once again.

This past Tuesday, the United Nations sounded the alarm that famine in Gaza is imminent. The famine warnings are bad enough that France, Germany, and the United Kingdom called for a ceasefire this past Friday. The mainstream media condemned Israel, including such outlets as the Guardian, CNN, NBC, and the New York Times. Of course, you did not see that sort of condemnation with the economic sanctions on Syria making lives more difficult for Syrian civilians, but I digress.

The famine accusation is nothing new. The World Health Organization said back in March 2024 that it was "imminent." In January 2024, the United Nations said that Gazans were facing famine in January 2024, although the UN's Famine Review Committee later got around to admitting in a May 2024 report that the allegations of an ongoing famine are unsubstantiated, as was a follow-up November 2024 report. Yet neither the United Nations nor the WHO have formally declared a famine as of date, in spite of warning about it for months. This might be because there has not been a famine. As we will see shortly, the situation on the ground is more complex than the mainstream media lets on.

Let us start with how the people of Gaza got into this mess in the first place. Hamas, the de facto ruling power in Gaza, started a war with Israel by raping, kidnapping, and murdering civilians on October 7, 2023. If Hamas did not instigate a war with a superior military power by committing the worst pogrom against Jews since the Holocaust, this suffering in Gaza could have been avoided. After all, in what other conflict or war in history has the "international community" asked a country to feed its enemy after the enemy attacked its civilians? Were the Allied powers supposed to provide humanitarian aid to Nazi Germany? Do we expect Ukraine to feed Russians after Russia started the Russo-Ukrainian War? I do not think so.

One could argue that because Israel has a genocidal neighbor on its western border intent on wiping out Israel, Israel has no moral obligation to help out such an enemy. This also does not take into account the reality that Hamas could have ended the conflict months ago by returning the hostages, but has not done so. Gazans could live in peace with their Israeli neighbors, but choose not to because the majority of Gazans would rather not have an Israeli nation exist. Even if you want to cite the Fourth Geneva Convention (Article 23) as a basis for Israel to help facilitate humanitarian aid, there is still a minor wrinkle in all of this: Israel has been and continues to facilitate the distribution of humanitarian aid to Gazan citizens.

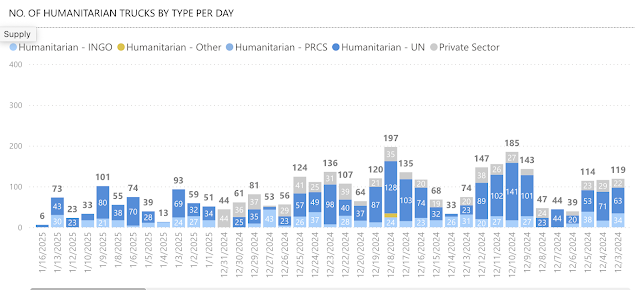

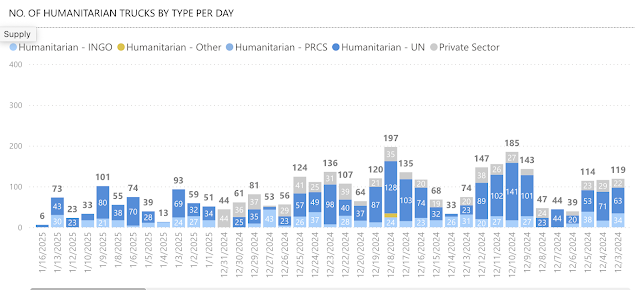

From January 2024 to July 2024, Israel supplied 478,229 metric tons of food to Gazans (Fliss-Isakov et al., 2025). This is the equivalent of about 3,000 calories a day, which is above the average recommended caloric intake is in the United States. It is not merely Israeli data that confirms the entry of 1.9 million tons of humanitarian aid into the Gaza Strip. The U.N. database for Supplies and Dispatch Tracking (see below) shows that humanitarian aid has been entering the war zone throughout the conflict.

If Israel were using starvation as a weapon, they would not have been facilitating the entry and distribution of humanitarian aid into Gaza. If Israel wanted to starve the Gazans, they would simply cut off their food supply and let them die. And if Israel were hellbent on destroying Gaza, there are more effective ways that do not endanger Israeli lives than fighting a defensive war. The claim that Israel wants to commit genocide against the Palestinians is simply fallacious (see here, here, and here), especially since you do not send humanitarian aid to or feed a population you are trying to wipe off the planet. Israeli and UN data show that using starvation as a weapon is far from what is happening. Plus, I have pointed out how Israel has taken more precautions than any other army in history to minimize civilian suffering, thereby further diminishing the "Israel is out to get them" argument.

If Israel is helping out, then why are Gazan civilians still starving? Last Friday (July 25), there were 950 trucks piled with 2,500 tons of food sitting idle in Gaza. The U.S.- and Israel-backed Gaza Humanitarian Foundation (GHF), which began operating in May 2025 to help distribute humanitarian aid to Gazans, offered to distribute the food sitting in the warehouses. However, the United Nations refused the GHF's help. This incident is but one example of what the situation faces with respect to food distribution.

It does not surprise me that the United Nations Relief and Works Agency for Palestinians in the Near East (UNRWA) does not want to help GHF with the task alleviating starvation in the Gazan war zone. As I brought up last year, UNRWA has sowed the seeds of victimhood and anti-Semitism that have allowed for Hamas to proliferate. Unlike other refugee organizations, UNRWA is not mandated to help resettle refugees. If anything, UNRWA has structural incentives that discourage it from resolving the crisis because expanding refugee rolls perpetuates UNRWA's large budget and continued donor funding. That same mechanism is in play with the food shortage.

UNRWA's institutional survival is contingent upon a large, dependent population. Crisis perpetuation attracts more humanitarian aid, not to mention that UNRWA is deeply entangled with the local power structures in Gaza, i.e., Hamas. Essentially, UNRWA's financial structure and institutional incentives do not reward resolving starvation, but rather reinforce a cycle of dependency and suffering. This refusal to work with outside humanitarian distributors underscores how UNRWA's operational control, as well as its incentives to maintain a dependent population, can obstruct effective relief delivery, even amid starvation.

It is not only UNRWA that reinforces suffering in Gaza. While the people of Gaza bear responsibility for electing Hamas and enabling Hamas' extremist ideology to flourish within Gazan society, they also live under an authoritarian terrorist organization that suppresses dissent and leaves few viable political options available, all of which fuel a cycle of violence and hate. It is especially sad for the children living in Gaza because they did not vote Hamas into power and cannot leave Gaza even if they wanted to leave. It is Hamas' violence and extremist ideology that help perpetuate the conflict in the Middle East.

That extremism includes such tactics as stealing humanitarian aid meant for civilians and profiting off of those commandeered goods, which the Left-leaning Washington Post got around to admitting to last week. As I have brought up before and as the Henry Jackson Society illustrates in its April 2025 report on the topic, stealing humanitarian aid is part of Hamas' greater modus operandi of using Gazan citizens as human shields.

In addition to stealing humanitarian aid, Hamas commits such acts as using humanitarian zones for military purposes, launching rockets from civilian sites, has a tunnel network built under civilian infrastructure, and use civilian structures as combat and weapons storage. By doing so, they garner international support, which is seen by the response of many in the West.

[7/31/2025 Addendum: After writing this post, this UN database that has been monitoring UN aid since May 19, 2025 was brought to my attention. It turns out that 85 percent of the collected aid, in terms of tonnage, was intercepted, either by crowds or armed individuals. This is not coming from the Israeli government, but on the United Nation's website for all the world to see. Some journalistic scrutiny instead of posting Hamas lies would be helpful.]

Delivering humanitarian aid in a war zone is difficult in the best of circumstances. Since it is compounded by UNRWA's incompetence and Hamas' extremism, it makes the suffering of Gazan civilians all the worse. As long as the world believes Israel is responsible, Hamas will continue to benefit from the moral cover, international funding, and political oxygen it needs to maintain power and bring suffering to the Palestinians that human rights activists claim to care about so much. If the world actually cares about Palestinian suffering, it has to confront Hamas' culpability with such substantial action as targeted sanctions on Hamas leadership or an independent humanitarian oversight mission. Until then, Gazan citizens will continue to suffer: not because Israel is starving them, but because Hamas is using their starvation as a weapon of war.