I don't find Perry's analogy to be transferable to Social Security. However, when looking at Social Security, I would contend that it is actually worse than a Ponzi scheme.

The Left, like those at the Center for Economic and Policy Research, point out that there is no deception involved. The Social Security Administration (SSA) has annual actuarial publications showing how much money there is (for whatever that is worth). I'm all for transparency, particularly when it comes to my tax dollars. However, if that were the sole factor, I wouldn't have a need to kvetch.

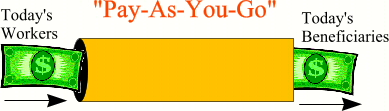

Many Americans are under the impression that it works exactly like a retirement fund, not a pay-as-you-go system. Hence the Ponzi-like deception that well-lauded, Keynesian economist Paul Krugman pointed out back in 1996. As the SSA illustrates (see below), Social Security is a pay-as-you-go system, not a Ponzi scheme. As I have explained before, Social Security does not mean you have a personal retirement account with your name on it. The money you put in now goes to fund today's beneficiaries, not you. Although the intent is not to defraud the beneficiary, the effect (i.e., the structure of having today's financiers pay for today's beneficiaries) is analogous.

The fact that the SSA clearly illustrates this on their website does not change the typical American's deception. The demographic change of the Baby Boomers retiring means that you cannot take out more than you put into the Trust Fund forever. If you think that this is not an issue, the New York Times already reported last year that the Social Security's payout exceeded the pay-in. This reality will be more pronounced when Social Security disability is supposed to run out of money in 2017, whereas the Trust Fund is to be depleted in 2037.

Another point of deception is that Americans are guaranteed to their Social Security benefits. Contrary to popular belief, the Supreme Court already ruled in the case of Flemming v. Nestor (1960) that Social Security is not a guaranteed entitlement.

For those of us who find out the insolvency of Social Security, not to mention the sub-par rate of return, what happens if we don't want to put into the system? In Ponzi, once I figure out how the scheme works, I can say "no" and subsequently would be able to get out of it. Once the scheme is totally exposed, it collapses. Not so with Social Security. If I opted to not pay my Social Security taxes, I would go to jail. I already know that doesn't get invested in a personal retirement account (PRA). In short, I am de facto coerced into putting into the Trust Fund and paying for current beneficiaries.

Coercion coupled with insolvency do not bode well for future generations. I would like to see privatization of Social Security. Although that would give an individual the highest rate of return, this will most probably not be a politically salient option (e.g., Bush's failed attempt to privatize Social Security). What we'll most likely see are more short-terms solutions such as raise the retirement age, raise taxes (which has been done multiple times already), a decrease in benefits, or perpetuate the status quo. Whatever the United States government does, I know that I won't be relying on Social Security as a retirement fund.

No comments:

Post a Comment