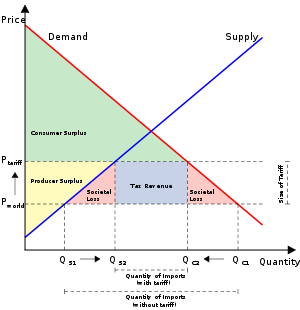

First, a brief explanation of a tariff. Essentially, a tariff is a tax or duty on goods entering or leaving the country. These taxes on imported or exported goods are meant to increase the price of a good, thereby making it more difficult to leave the country. As the supply-demand graph of a domestic country shows below, the benefits are unevenly spread out. Most obvious is that the government collects tax revenue. Domestic industries also benefit since they have reduced competition. The real losers of a tariff are the consumer since tariffs result in higher prices of goods. There is deadweight loss (also referred to as societal loss) that takes place with a tariff, much like it does with any other tax. Unsurprisingly, the tariff benefits the few [who are the politically connected] at the expense of the American consumer.

This is not simply a matter of economic theory or general consensus amongst economists that tariffs reduce economic welfare, thereby lowering the standard of living. The Right-leaning American Action Forum released a policy brief last week on Trump's proposal to significantly raise tariffs on China and Mexico by 45 and 35 percent, respectively. The end result could end up costing Americans up to $250 billion per year! This is hardly the first time that tariffs have been shown to have an adverse impact on citizens. A few more examples:

- According to a paper from the National Economic Research Bureau, a freer economy translates into greater economic growth (Estevadeordal and Taylor, 2008).

- The Right-leaning Heritage Foundation shows how tariffs make Americans poorer and with lower economic welfare (Riley, 2013).

- The Federal Reserve found that economic welfare losses of tariffs were high enough to actually encourage monopolies (Schmitz, 2012).

- Developing nations with lower trade barriers have lower poverty rates (Bergh and Nillson, 2011), which was notable in Mexico (Hanson, 2005), India (Goldberg, 2009), Vietnam (Heo and Doanh, 2009), and Indonesia (Kis-Katos and Sparrow, 2013).

- Fewer trade barriers positively correlate with greater happiness (Kaupa, 2012).

- The Federal Reserve Bank has shown that the United States has, on the whole, benefitted from trade with China (Caliendo et al., 2015).

- Greater trade helps the poor by lowering cost of living (Fajgelbaum and Khandelwal, 2015; Marchand, 2012).

- A World Bank Study shows that liberalizing trade, as opposed to higher tariffs, means greater economic growth (Wacziarg and Horn Welch, 2008).

- The World Health Organization found that pharmaceutical tariffs are a regressive tax that adversely targets the sick (Olcay and Laing, 2005).

- Greater international trade is correlated with a higher per capita income (Feyrer, 2009).

- This policy brief from the Mercatus Center addresses some of the myths surrounding free trade (Boudreaux, 2015).

While there are many more studies that can be elucidated upon, the point I am making is that study after study shows that tariffs are problematic. As economists have pointed out, freer trade is better for the economic wellbeing as a whole. Rather than give into protectionist myths and scare tactics about losing jobs, we should encourage presidential hopefuls, and indeed all politicians, to liberalize trade.

3-27-2016 Addendum: In case there were not enough reasons to be worried about Trump's tariff plan, the chief analyst at Moody's Analytics just ran a model with Trump's proposed tariff rates, and the end result would be over 3 million less American jobs and an economy that would be 4.6 percent smaller by 2019.

9-25-2016 Addendum: The Peterson Institute recently released a paper on the presidential candidates and what would happen if their trade plans were fully implemented. For Trump, his trade plan of a full-out trade war would mean recession and increased unemployment.

10-6-2016 Addendum: The University of Chicago's Initiative on Global Market's panel of economic experts were asked if tariffs were good policy, and not a single one thought that enacting tariffs to encourage production in the United States is a good idea. Nice to see economists agree on something!

1-17-2017 Addendum: New research (Furman et al., 2017) shows how tariffs act as a regressive tax that most adversely affects the poor.

I'm unsure if Trump knows this information and has some tactic in mind, or if he genuinely knows very little about economics.

ReplyDeleteThis comment has been removed by the author.

Delete