Immigration has been a major topic in the election cycle. President Trump likes to be on tough on immigration by proposing such wild and crazy alternatives as deportation while pointing out Vice President Kamala Harris' ineptitude as the unofficial Border Czar. I can point out how Trump has been too tough on immigration at the country's detriment by being against all forms of immigration. Although the United States can attribute its historic economic success to immigration, this country has been become more anti-immigration in recent years (Gallup).

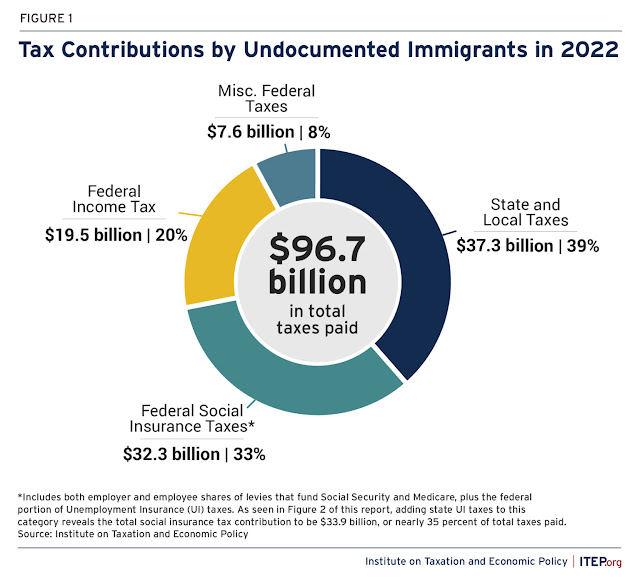

One of those anti-immigration myths that never seems to die is that immigrants do not pay taxes. The premise behind this myth is to make undocumented workers (also known as illegal immigrants) look like all they do is take without giving anything back, especially those who work "under the table." In spite of this pervading myth, the truth of the matter is that undocumented immigrants pay taxes. In fact, they pay a lot in taxes. According to a report from the Left-leaning Institute on Taxation and Economic Policy (ITEP) that was released last week, undocumented immigrants paid $96.7 billion in federal, state, and local taxes in 2022.

To give you an idea of a further breakdown of what that looks like, here is a list of the main taxes that undocumented workers pay:

- Social Security tax: $25.7 billion

- Federal income tax: $19.5 billion

- Sales and excise tax: $15.1 billion

- Property tax: $10.4 billion

- Personal and business income taxes: $7.0 billion

- Medicare tax: $6.4 billion

- Unemployment insurance tax: $1.8 billion

To put this in perspective, ITEP found that undocumented workers paid an average effective state and local tax rate of 8.9 percent, which is higher than those in the 1 percent of the income scale who paid 7.2 percent. Although I wrote on the topic of "undocumented immigrants and taxes" back in 2014, it feels like it merits repeating. Rather than the moocher stereotype that nativists like to portray, immigrants are hard workers who pay taxes and contribute. As a 2023 research paper from the libertarian think tank Cato Institute illustrates, immigrants make a net positive fiscal impact to the United States (see below).

Not only do immigrants pay taxes, but allowing for more immigrants could help reduce the budget deficit. This means that the taxes that undocumented workers pay fund government programs without straining government welfare or entitlement programs. If anything, legalizing the undocumented workforce would help bring even more government revenue into the coffers instead of having it spent in the underground market.

Furthermore, allowing for immigrants would not only be good for the federal budget. The other benefit of letting in more immigrants is that it positively contributes to the economy as a whole for native-born citizens and immigrants alike. Fixing the United States' broken immigration system is going to be a long and arduous road. In order to do it, we should at least approach it with the facts on the ground instead of half-baked theories.

No comments:

Post a Comment