Earlier this summer, Congress passed the Inflation Reduction Act (IRA). In spite of the name, the legislation is not going to reduce inflation. It will have negative implications for the economy. Its drug pricing provisions will make us less healthy as a nation. In addition to the economic and health aspects of the bill, the IRA attempts to reform another aspect of life: the environment. The environmental portion of the IRA mostly entails tax credits for clean energy (see below, as well as a summary from the Bipartisan Policy Center here). The Democrats claim that the IRA will lower energy costs and increase energy security, amongst other environment-related goals. Today, I would like to examine some of the environmental provisions of the IRA and see if the what, it anything, the IRA will do of significance to save the environment.

Will the IRA Mitigate Climate Change? Not Really.

According to the Rhodium Group (see below), most of the projected reduction in greenhouse gases was going to happen regardless of whether the IRA passed or not. Second, these projections below show that the IRA would not bring us to the levels under the Paris Climate Agreement. I did not think the Paris Climate Agreement was a good idea. Even if it were, this reduction in up to 1.7 billion metric tons by 2030 does not show how much global temperatures would drop. Bjørn Lomborg of the Copenhagen Consensus made a calculation using Rhodium's estimates. In the best-case scenario that the IRA's funding would extend to 2100, Lomborg found that the IRA would only reduce global temperatures by a measly 0.028 Fahrenheit. Lomborg similarly calculated that the IRA's impact on sea level would be 0.006-0.008" lower in 2100. To bring this point home, the Right-leaning Heritage Foundation calculated that even if we removed all fuel-based carbon emissions, it would reduce the global temperatures by 0.2 degrees Celsius by 2100 (Dayaratna et al., 2022). These statistically insignificant outcomes is what the taxpayers get after $369 billion.

The Futility of the Electric Vehicle Provisions

Electric vehicles (EV) have become a

cause célèbre for the Left because many on the Left view EVs as a panacea to deal with climate change. This ignores a number of facts regarding electric vehicles. One is that

61 percent of electricity comes from fossil fuels. Another is even with preexisting

tax credits, electric vehicles only account for 1.8 million out of the 270.9 million vehicles in the United States, or less than 1 percent of all vehicles (

IEA;

Statista). This implies that subsidies or tax credits have not gotten electric vehicles off the ground. Additionally,

a 2022 study from J.D. Power found that electric vehicles have greater quality issues than regular vehicles.

If were to ignore everything in the previous paragraph, Pete Buttigieg's tone-deafness of suggesting people buy electric vehicles to fight inflation is still the modern-day equivalent of

qu'ils mangent de la brioche (let them eat cake). Here is why. The average price of an electric vehicle

is $64,000, which

is $16,000 more than the cost of an average vehicle. The maximum federal tax credit allowed under the IRA is $7,500 (

Congressional Research Service [CRS]). As the CRS

points out, 78 percent of past electric vehicle tax breaks have benefited filers with greater than $100,000 in adjusted gross income. If the prohibitive costs were not enough, the conditions to acquire the tax credit are overwhelming. These requirements for the tax credit are bad enough (see below) where the Alliance for Automotive Innovation

estimates that none of the electric vehicles would be eligible for the full credit once sourcing requirements are considered.

- Credits will only be allowed for SUVs, vans or pickups less than $80,000; and for other vehicles less than $55,000 (CRS, 2022, p. 14).

- The credit also is limited to those making less than $150,000 in AGI (ibid.), which makes even less sense since you need a high income to afford a $70,000 post-tax credit.

- The IRA disqualifies electric vehicles with battery components manufactured or assembled by "a foreign entity of concern" (ibid.). China is a "foreign entity of concern" that happens to produce 60 percent of battery cathodes and 80 percent of all anodes (Ward's Auto).

- Another qualification for the credit is to have critical minerals sourced from free trade agreement partners (CRS, 2022, p. 14), which is basically impossible in today's market.

- The electric battery vehicle has to be manufactured in North America or a free trade agreement partner (ibid.). The catch is no electric vehicle currently meets that qualification.

Furthermore, these restrictions will have a

similar effect to Trump's ridiculous "Buy American" laws: limiting the supply of various inputs will drive up costs for electric vehicles further. In short, the IRA will not make electric vehicles more accessible. They will likely make them more expensive as a result of all of these provisions.

Clean Energy and Efficiency Incentives for Individuals

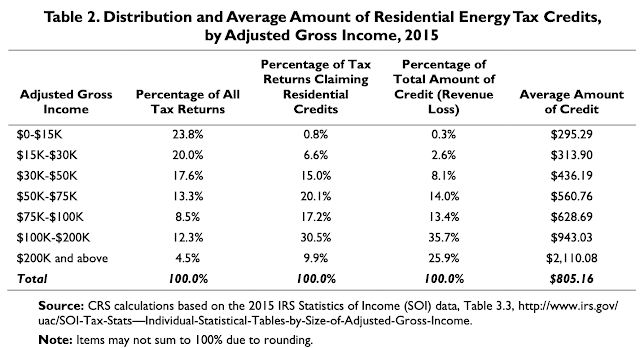

The IRA extends and expands the previous tax credit for qualified energy-efficiency improvements for residential property. This expansion will be 30 percent up to an annual taxpayer limit of $1,200 and a $600 per-item limit (CRS, 2022, p. 12). These tax credits would go towards such expenses as solar panels and updating appliances. These tax credits are not subject to income limits.

Resources of the Future

estimates that the IRA will lower electricity costs by $170-$220 a year. The Left-leaning Brookings Institution is more confident in the IRA because it

brings up that the IRA could help save a household $1,800 a year if a household installs a modern electric pump, a heat pump for water heating, converts to an electric car, and installs solar panels. We already covered the electric car provisions, but the rest of this estimate is covered under the individual tax credit in question. Even assuming that Brookings' estimate is correct, what makes Brookings think this will greatly benefit disadvantaged communities?

The upfront costs of installing a

heat pump is nearly $6,000, whereas the average installation cost of

rooftop solar panels is $20,000. Since lower-income households have more pressing matters than being energy-efficient, it makes sense that previous energy-efficiency home improvement tax credits disproportionately benefitted those making over $100,000 (

CRS, 2018, p. 10; see below). A study from Berkeley University similarly found that 60 percent of clean energy tax credits go towards the top quintile (

Borenstein and Davis, 2015). This is not helping the environment. This is green welfare for the affluent, not too dissimilar to Biden's

student loan "forgiveness."

Renewable Energy Investments

The production tax credits (PTC) are the largest budget item amongst the environmental provisions. They are also the most predictable since the PTCs are an extension of a previously existing program. There are problems with the PTC aside from the ones I brought up

eight years ago, such as higher cost of renewables (especially wind), distorting energy demand, and wind is an intermittent and unpredictable power source. Here are some other ones:

- The Congressional Research Service brings up that the evidence for its effects on reducing greenhouse gases is mixed (CRS, 2020, p. 9).

- The CRS expresses concerns that these subsidies do not "necessarily provide a comparable incentive for all emissions reduction alternatives, and may favor more costly reductions over less costly ones (CRS, 2020, p. 10)."

- The Texas Public Policy Foundation describes in detail how the PTC cause distortions to the electricity market (Erickson, 2018, pp. 7-8). As the Institute for Energy Research illustrates, states with major increases in wind and solar saw electricity prices increase 18 to 36 percent between 2009 and 2017. This is in contrast with the national average of 7 percent in the same time period.

- The U.S. solar industry is currently undergoing supply chain disruptions and tariff uncertainty (Reuters).

Conclusion

A bill that does nothing significant to lower global temperatures, an electric vehicle tax credit that is all but unusable, energy efficiency credits that benefit the rich, and questionable production tax credits. That is the environmental impact of the IRA. Even if there were some benefit to be derived, none of what I have previously covered here gets into whether or not climate change is the emergency Biden purports it to be.

According to a

New York Times poll in July 2022, only one percent of Americans think climate change is the most important issue facing us. As the Right-leaning Heritage Foundation

pointed out, the most recent United Nations Intergovernmental Panel on Climate Change found the likelihood of such an emergency scenario to be of "low likelihood." I have pointed out on multiple occasions (most recently

in November 2021) that we need to stop using improbable worst-case scenario modeling to dictate environmental policy. Congress has allocated over $300 billion to an issue that is unlikely to be a problem by the end of the century, never mind now. Ultimately, the environmental provisions in the IRA are moral posturing that provide little actual reform to the energy market.

No comments:

Post a Comment