It might have faded from the U.S. media's attention, but France has continued the protests that started on January 19, 2023. I know that holding protests is part of French tradition. What has the French so upset that they have been protesting for the better part of four months? Pension reform. In a very unpopular move, President Emmanuel Macron raised the retirement age from 62 to 64 by 2023. Why would he do something that would have the French citizenry in such an uproar?

France has one of the lowest retirement ages in the industrialized world. France also has one of highest percentages of public spending on pensions (OECD). France spends 14.5 percent of its GDP on pensions, which is almost double the OECD average of 7.7 percent. Furthermore, the worker-to-retiree ratio is expected to decrease from 1.7 in 2019 to 1.2 in 2070. This worker-to-beneficiary ratio is even more dire than that of the United States' Social Security by 2040.

This past Friday, Fitch Ratings downgraded France from an AA credit rating to AA-. This downgrade took place because of weak economic growth and continued increase in the debt-to-GDP ratio due to upward expenditure pressures (including pensions and social benefits). If that were not enough to satisfy you, look at the European Commission's 2021 Aging Report. The EC found that unchanged eligibility requirements (especially age) would have a sizable impact on pension expenditures. For France, it would mean an increase of 2.2 percentage points of GDP (EC, p. 95), which is higher than the European Union average.

The people over at the far-Left Fairness and Accuracy in Reporting (FAIR) were dismayed by the U.S. media's coverage of these protests because it did not even entertain the possibility of France increasing taxes to fund the pensions. Let's entertain the thought for argument's sake. A panel of economic experts sponsored by the University of Chicago was asked about France raising its retirement age in comparison to two other policy options. The first policy option was raising social security taxes. Out of the economists that did answer, 87.8 percent believed that raising the retirement age was a better option to preserve the financial viability of France's pension system than raising taxes.

As OECD data indicate, France already has a high marginal tax rate for social security contributions. According to accounting firm PwC, "the contributions are shared between employer and employee; on average, the employer 's share of contribution represents 45% of the gross salary. For 2022, the employee's share of French social contributions represents approximately 20% to 23% of the remuneration." 2022 calculations from the Right-leaning Tax Foundation found that marginal tax rates in France's social security taxes are so barking mad that a pay raise could face as much as 93 percent of that raise being taken as tax revenue. Raising taxes higher would only create deadweight loss that suppresses France's economic growth.

The second policy alternative is lowering the current benefits. As University of Minnesota economics professor Kjetil Storesletten brings up, current benefit amounts are locked into place. Future benefits take a long time to pass and take into effect. The political backlash would be higher for cutting benefits than raising the retirement age. Similarly, there has been political backlash in France (i.e., 1987, 1993, and 2010) when the French government cut spending elsewhere in its budget.

That being said, it is not like the France cannot handle it. France did not always have such a low retirement age. Former President François Mitterrand changed the retirement age to 60 in 1983. Beforehand, the retirement age was 65. Plus, the retirement age increased from 60 to 62 in 2010. I am sure that those who are protesting (middle-aged workers in particular) are worried that they will not have the same benefits.

I would suggest encouraging French citizens to save retirement. The sad truth is the cultural expectation set for retiring French citizens is that the government will take care of them in their later years. On top of that, you have a different work-life balance that views early retirement in a more positive. How work was viewed and valued was clear to me when I visited France and talked with French citizens a few years ago.

As much as I understand that cultural norms around work are different in France, I understand even more the fiscal reality of what happens when you consistently pay out more money into a system than you accrue. It is not sustainable and something needs to be done to contain costs. Fitch Ratings found that raising the retirement age would create annual gross savings of EUR17.7 billion by 2030, or 0.6 percent of the GDP.

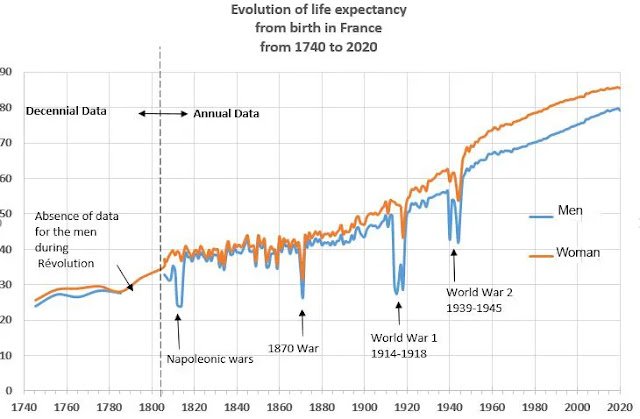

Aside from fiscal reality, there is demographic reality. People in France are living longer with an average age of 85 for women and 79 for men (see below). France has a birth rate of 1.8, which is below the replacement rate of 2.1. Without a solution of actual reform, an overburdened system will eventually become insolvent.

If your goal is to provide a pension system for your retirees to live on, then there has to be a way for it to last in the long-run. Increasing taxes in a country that already has such high tax rates will only make it more difficult to sustain its social security program and other government services. Much like I explained in 2013 when I argued for raising the retirement age for Social Security in the United States, raising the retirement age is that compromise one has to make in order for long-term solvency. People working longer not only means retirees withdrawing payments for as long, but it also means more people contributing to the system. Since both France and the United States have pay-as-you-go systems for their retirement accounts, I would surmise that France's issues are a canary in the mine for the solvency issues facing the United States with Social Security. While it is not a politically popular move, I at least give Macron kudos for having the balls to address an important issue that so few politicians in the United States are willing to tackle.

No comments:

Post a Comment